Superfluid collateral or how the new hype cycle started

We explore how liquidity mining works and how it inflates risks and DeFi token prices

Since the inception of the WZRD fund, we believed that the new bull cycle in crypto will begin with the introduction of native debt and quick to follow complex derivatives on that debt. Why? Because historically when people explore new ways to exchange value, e.g. creating equity and debt markets they begin to exploit the system to make a profit while everything is going up. And the best way for markets to continue to go up is through debt.

Well, now this is happening IRL. In the past few months, DeFi has exploded in Total Value Locked and market caps, leaving everyone wondering why. The main recipe for such growth is complex mechanisms that thrive on bad debt, but stay unnoticed for the observer because of their complexity.

In this essay, we will explore how liquidity mining works, why it’s even needed, and how it is all connected to the creation of more debt.

First, we need to acknowledge the fact that the crypto community has embraced DeFi as a legal arbitrage at its core and stopped shying away from cash-flow generating tokens – that is when protocols take a cut of generated fees and give it to token holders. More on that later.

However, the protocol's founders can’t legally sell equity-like tokens to retail investors, so how to give the token to the community and first of all to users, not just speculators?

That is where liquidity mining comes in and makes it all work. To get such an equity-like token you need to provide some value to the protocol – mostly liquidity. In Compound for example you get a COMP token for providing a loan to someone.

The next example of such liquidity mining (or yield farming) is currently one of the most popular – earning interest on DAI through Curve.finance while simultaneously mining a CRV token. We’ll get into details here to showcase how it leads to more bad debt in the system.

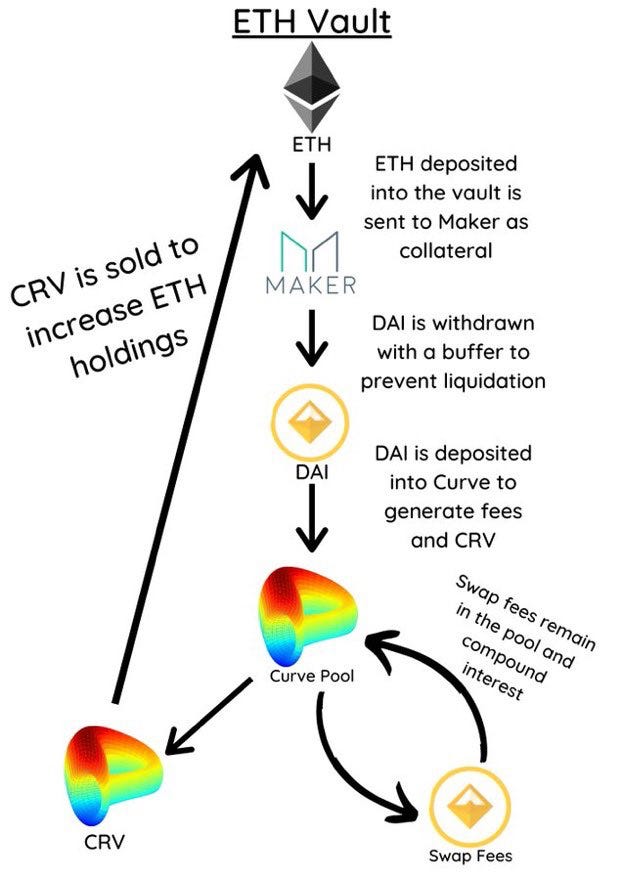

This common way to provide liquidity to Curve protocol is through Yearn.finance, a service that automates complicated strategies for yield farming. Simplified scheme of what is happening under the hood below:

1) You put ETH into Yearn.finance vault called yETH;

2) Yearn automatically moves it to Maker DAO and borrows DAI with your ETH as collateral (ensuring 200% collateral ratio in case ETH price goes down);

3) Then Yearn deposits borrowed DAI in yDAI vault and gives this liquidity to Curve Finance Y pool;

4) Now your yDAI provides liquidity to Curve, generating fees for you in the form of CRV tokens. (Curve needs your DAI to ensure liquidity for people who trade between different stablecoins);

5) Your newly received CRV will be automatically sold for ETH which then again will repeat the whole cycle from step 1.

As you can see, this scheme of liquidity mining creates buying pressure for ETH (people buy it just to participate in mining), then ETH is leveraged up to mine CRV, which is sold to get more ETH, and mine more CRV. This is the simplest liquidity mining scheme with not as many risks.

Obviously, liquidity mining is happening not only with ETH or DAI, it is happening primarily with other assets and in the process inflates them as well. But, things become more interesting with liquidity provider (LP) tokens that you get in exchange for the asset you provided to the protocol.

Let's see an example of providing Curve with sUSD, which is a synthetic stable coin that is debt in itself (like DAI), created with SNX token. When you provide sUSD to Curve you get the LP token called sUSDv2 in exchange. But guess what. You can mine a bunch of other tokens with sUSDv2. With the collateral locked in one protocol miners can earn several different tokens. Such liquidity mining schemes with the reusability of collateral are happening all over the place, which in turn creates even more buying pressure for tokens like ETH or SNX, that are used to get LP tokens.

If this scheme is difficult to grasp when you begin to explore other liquidity mining strategies it gets even more unapologetically complex.

For example, liquidity providers can use LP tokens they got from providing liquidity to Uniswap pools to get more debt on platforms like AAVE, using LP tokens as collateral. And the list goes on. The fact is, almost all of the most lucrative liquidity mining schemes are highly leveraged positions backed by bad collateral like LP tokens used in several places simultaneously.

So why do all these protocols even do that? The answer is Total Value Locked or TVL – the simplest metric to judge protocol’s success in DeFi, as the higher TVL protocol has, the more fees protocol will be able to amass and share with token holders, therefore its market capitalization should go higher. The price of token rises, liquidity providers can get more debt for less collateral, and mine more new hot tokens, and the cycle repeats.

The most dangerous thing now is that you are exposed to the underlying risks even if you don't participate in liquidity mining. In 2 months these risks have been sewn into the whole Ethereum ecosystem.

The next stage has already begun with Yearn.finance Vaults and more yield generating strategies provided by community members. We strongly believe the founder has a good intent by providing automated schemes for liquidity mining and we as investors with significant allocation in Yearn’s token YFI see the protocol as the center of the newly emerged equity and debt market. But at the same time, we understand that It might take just a few weeks before opportunistic platforms will hook up to Yearn.finance and make it incredibly easy for the average person to earn perceived 500% or more without understanding any risks of the underlying mechanisms.

That's how we believe the craziest part of this cycle will begin. If earlier, in 2017, it was very difficult for an average person to understand what’s going on in crypto and why, now it will become impossible. The best thing we can do as a fund is to ride this new bull cycle, watch collateralization ratios of these subsystems, manage portfolios accordingly, and educate the market about underlying risks.

The next frontier is to make insurance products work. Interestingly, insurance is usually playing a huge role in economic bubbles and we believe it will also have a sizable part in the growth of DeFi by adding to the complexity of the market and ROI generating strategies for DAO funds. But the role of insurance in Defi will be a theme for the next essay.